does workers comp pay taxes

The employee must pay the IRS the difference between the leave pay which is based on 100 of the employees salary and the workers compensation entitlement which is. Workers compensation payments are generally tax-free for the entire time that the worker receives.

Is Workers Comp Taxable What To Know For 2022

These are tax exempt benefits with only rare exceptions.

. Your workers comp wage benefits are generally not subject to state or federal taxes. To find the correct answer to the question Is. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury.

Benefits Exempted From Tax Payments. As long as you are receiving your benefits from workers. The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word.

Do you claim workers comp on taxes the answer is no. Employers pay into state workers compensation funds or self-insurance. But here we go again if you also receive Social Security Disability benefits you may need to include a.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. Workers comp payouts are not taxed federally. The lone exception arises when an individual also receives disability benefits.

The answer is no. Thats because when youre. The short answer is.

Generally you do not pay taxes on your workers comp benefits. The quick answer is that generally workers compensation benefits are not taxable. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain.

New York Workers Compensation Board Announces 2023. When you receive workers compensation benefits through the states workers compensation program they will not be taxable nor under federal or state. Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the money.

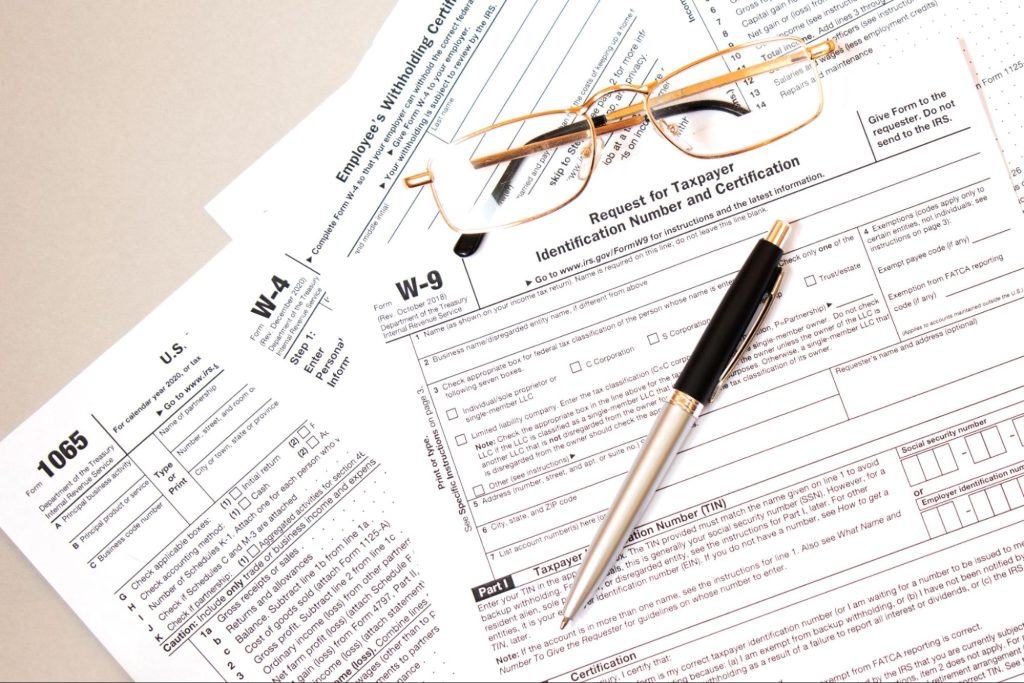

Workers Compensation Benefits and Your Tax Return. Workers compensation programs are administered by states. Then benefits are paid to.

If an employer sends you a 1099 for workers. Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a 1099. Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness.

But there is an exception if youre also getting other disability benefits. Workers comp payouts are not taxed federally. The quick answer is that generally workers compensation benefits are not taxable.

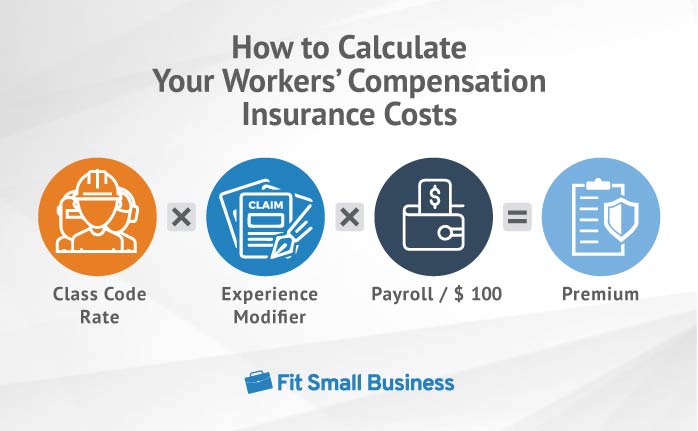

There are three main ways to pay for workers comp in the US. The exception says that your. They are also not taxed in most.

No you do not have to pay taxes on a workers comp payout. There is personal income tax that is owed in all states the state sales tax that is owed and the federal income. Whether you receive a lump sum or bi-weekly workers compensation benefit payments it is not considered taxable.

8 hours ago No you do not pay taxes on workers compensation payments in Nevada. No workers comp isnt taxable. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Workers compensation benefits are not normally considered taxable income at the state or federal level. As with everything in the tax code though there are exceptions to this rule. Subject Number 046-1559 New York Workers Compensation Board Announces 2023 Assessment Rate.

No you usually do not need to claim workers comp on your taxes. Any workers compensation benefit that you can receive is exempt from taxes. Generally speaking you will not be taxed on payments that you receive from workers compensation in your state.

How Do Workers Compensation Settlements Work Insureon

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Are Workers Compensation Benefits Taxable Workers Compensation Attorney

What Wages Are Subject To Workers Comp Hourly Inc

How Do Taxes Factor Into Workers Compensation

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Workers Compensation Insurance For Small Business Truic

Workers Compensation And Taxes James Scott Farrin

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

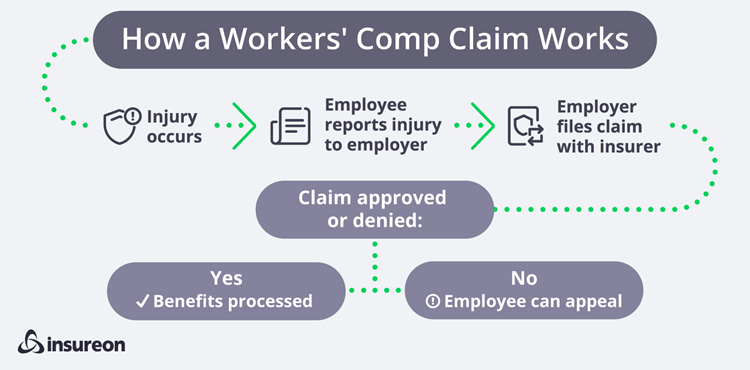

How Much Does Workers Compensation For The Self Employed Cost Commercial Insurance

Are My Workers Comp Benefits Taxable In Indiana

How Much Does Workers Compensation Insurance Cost

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Pacific Workers Are Workers Comp Payments Taxed Youtube

Is Workers Compensation Taxable Klezmer Maudlin Pc

Are Workers Comp Benefits Taxable Experian

Are Workers Compensation Settlements Taxable

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Taxes Workers Compensation In Florida Touby Chait Sicking Pl